What the One Big Beautiful Bill Act (OBBBA) Means for Solar and Battery Projects

A New Law, New Deadlines, and New Risks

The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, introduces sweeping changes to how solar power and energy storage projects qualify for federal tax credits. While the legislation aims to strengthen the long-term clean energy market, it also creates short-term urgency for building owners, developers, and third-party investors.

If you’re considering solar or battery storage, the next 12 months are critical for locking in the most favorable financial terms—and avoiding future compliance headaches.

Key Deadline Changes for Tax Credit Eligibility

The OBBBA updates how and when projects can qualify for the Investment Tax Credit (ITC) and Production Tax Credit (PTC), two of the most valuable incentives available.

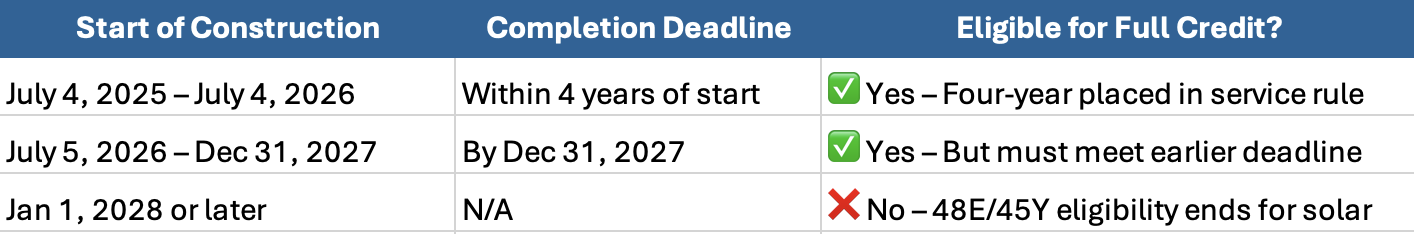

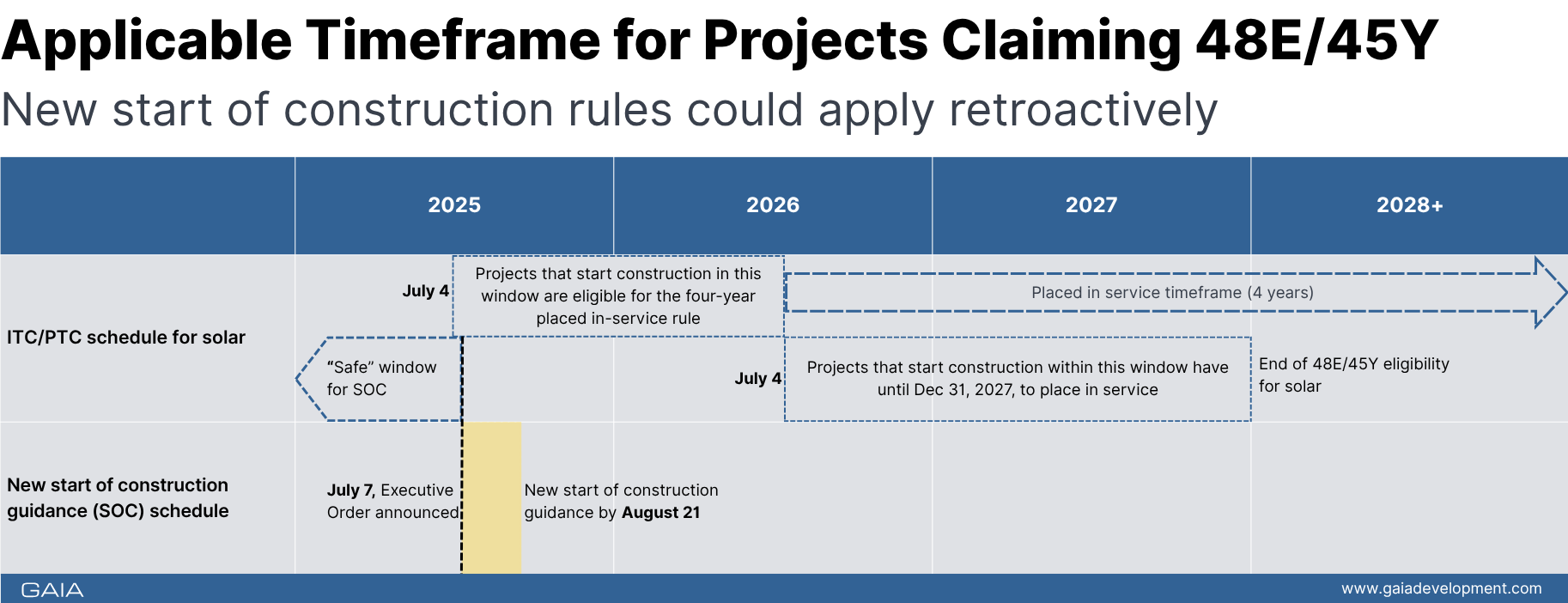

Here’s how the new timeline works:

Start construction before July 4, 2026 → You get up to 4 years to complete your project and still receive full tax credits.

Start after July 4, 2026 → Your project must be placed in service by December 31, 2027 to qualify for full credits.

“Placed in service” means your system is fully installed, connected, and producing electricity.

Standalone battery storage projects follow the original phase-out schedule from the Inflation Reduction Act (IRA), which reduces the credit percentage over time.

Overview:

Safe Harbor Just Got Stricter

Safe Harbor allows developers to “lock in” tax credits by starting physical work or spending at least 5% of total project costs.

But under OBBBA, these provisions will now face tighter scrutiny from the IRS and U.S. Treasury. New guidance is expected by August 21, 2025. That means documentation and timing will matter more than ever—and waiting could put your project at risk of losing eligibility.

New Rules on Equipment Sourcing

OBBA introduces manufacturing origin requirements for solar panels, batteries, and other key system components. Starting in 2026, a growing percentage of your equipment must come from approved, non-restricted sources.

The phased-in sourcing requirements are:

40% in 2026

45% in 2027

50% in 2028

This could impact costs and availability, especially for projects with longer procurement timelines or tight budgets. Early planning is essential to meet these targets.

What About Third-Party Owned Projects?

Many building owners use third-party models like power purchase agreements (PPAs) or solar leases, where a developer or investor builds and owns the system, and the owner simply buys the electricity or leases the roof.

The challenge now?

If construction doesn’t begin before July 4, 2026, third-party investors may lose access to full tax credits—making deals less financially attractive. That could result in:

Fewer developers willing to take on projects

Higher energy rates

Less favorable terms

Missed opportunities for “no-cost” solar installations

Tightened Safe Harbor rules and sourcing requirements may further slow project approvals, leaving building owners with fewer viable offers.

Why Now Is the Time to Act

OBBBA’s new start-of-construction rules affect whether your project qualifies for the full ITC/PTC. Here’s how your eligibility changes based on when construction begins:

Delaying a project could mean losing out on thousands in tax savings and fewer third-party financing options. If you’re evaluating solar or energy storage, 2025–2026 is your window.

How GAIA Supports Solar and Storage Projects

Our team helps building owners, asset managers, and developers navigate solar and battery strategy at both the single-site and portfolio level.

Pathway 3: Site-Level Services

Solar and battery feasibility studies

RFP development and contractor selection

Design and construction verification

Pathway 4: Portfolio-Level Strategy

Multi-site program development

Prioritization and financial modeling

Sourcing strategy and implementation support

Ready to Maximize Your Credits?

Whether you’re exploring solar for a single building or planning a multi-site rollout, now’s the time to act. The rules are changing—and we can help you stay ahead of them.

Contact us to start a feasibility study or portfolio strategy session.

| Service | Description | Lead Consultant |

|---|---|---|

| LEED Consulting | Guidance on LEED certification and documentation | Alex Morgan |

| Solar Feasibility | Analysis and ROI modeling for PV installations | Jesse Chen |